We’ve compiled a list of the ten best accounting software and calculators to help you save money! These tools will make it easy to keep track of your income and expenses and stay on top of your budget.

How to save money as a startup employee?

All startup employees can do a few key things to save money. Here are some tips:

1. Use accounting software:

There are several accounting software programs available, and they can help you keep track of your expenses and income. This will help you stay on top of your budget and avoid overspending.

2. Make a budget:

It’s essential to create a budget and stick to it. This will help you stay within your spending limits and save money.

3. Shop around for deals:

When you need to buy something, shop for the best deal. There are often great deals to be found if you’re willing to look for them.

4. Cut back on expenses:

There are often ways to reduce costs without making significant changes in your lifestyle. Try tweaking your budget to see where you can save money—for example, reducing your taxable income by investing your savings in a trust.

5. Live below your means:

One of the best ways to save money is to live below your means. If you can afford to live modestly, you’ll be able to save more money in the long run.

6. Invest money wisely:

If you have extra money, invest it wisely so it can grow over time. This will help you build your savings and ensure a solid financial future.

7. Avoid debt:

One of the best ways to save money is to avoid debt altogether. If you can live within your means and avoid too much debt, you’ll be financially well.

8. Stay disciplined:

Sticking to a budget takes discipline, but it’s worth it in the end! If you can stay disciplined with your spending, you’ll be able to save more money each month.

9. Think long-term:

Saving money is not always easy, but thinking long-term about your financial goals is essential. If you can make small sacrifices now, you’ll be able to enjoy the benefits later on down the road.

10. Have patience:

It’s essential to be patient when saving money. Rome wasn’t built in a day, and neither will your savings account! Be patient and consistent with your efforts, and you’ll see long-term results.

Best Accounting Software and Calculators to Save Money As A Startup Employee

1. Wave

Wave is a free accounting software that allows startup employees to manage their finances. It has various features that can help you keep track of your income and expenses, including invoicing, accounting, and payroll. It is an excellent choice for startup employees who must stay on top of their finances.

To find Wave online, go to waveapps.com and click “Sign In” in the top right-hand corner. Then, enter your email address and password and click “Sign In.” If you don’t have an account, click “Create a New Account” and follow the instructions.

2. QuickBooks

QuickBooks is a popular accounting software used by businesses of all sizes. It can help you manage your finances, track your income, and create invoices. In addition, QuickBooks is cloud-based so you can access it from anywhere. It is an outstanding choice for startup employees since they’re used to regularly moving from one place to another.

Create an account and enjoy this app’s various advantages.

3. FreshBooks

FreshBooks is a cloud-based accounting software popular among small businesses and startup employees. It offers various features to help and advise you on managing your finances. Plus, it’s one of the most user-friendly apps on this list!

FreshBooks also has a mobile app to access your devices, keep track of your finances, and organize your monthly savings. Therefore, it becomes an excellent choice for startup employees who need economic stability.

To find FreshBooks online, go to freshbooks.com, click “Create a New Account,” and follow the instructions. If you’re used to online tools, signing in will take you just a few minutes!

4. Valur

Valur’s app offers a different way to save money. It developed a Charitable Remainder Trust calculator, which benefits startup employees who want to save on taxes when selling their assets. Unlike the other sites that help you track your finances, they help you reduce your taxes and grow your wealth faster.

Let’s say you’re a startup employee who owns an asset (or several) whose value has grown over the years, and now you want to sell it. Usually, this means you’ll have to send a massive amount of the earnings from the sale to the government, losing a significant portion that could have been your savings. But using a Charitable Remainder Trust, or CRT, with Valur would allow you to avoid those taxes.

Working with Valur will allow you to evaluate the benefits, returns, and tax deductions of the CRT in the long term!

5. Xero

Xero is a cloud accounting software that startup employees can use to manage their finances. It offers a variety of features, including invoicing, accounting, and payroll. It also has a mobile app.

However, Xero is designed specifically for small businesses. Consider it a superb choice for startup employees just starting. Xero also has a wide range of integrations, allowing you to connect it with other apps you might be using, such as Google Drive or Salesforce. Therefore, it’s easier to keep track of your finances and your business’ progress.

6. Nutcache

Nutcache is a cloud-based accounting software that helps startup employees and small businesses manage their finances. Like most apps we’ve described, this app offers invoicing, accounting, and payroll features, plus mobile usability!

This app has a wide variety of integrations besides billing assistance. Nutcache helps you manage projects, tasks, resources, and more with Professional Services Automation (PSA) software. Therefore, you can keep track of your duties as a startup employee in one app. Organize your economic goals!

7. Sage One accounting

Sage One accounting is an accounting software that helps startup employees and small businesses manage their finances and savings in the long term. What makes Sage One accounting unique is its scalability. Startup employees can grow their businesses alongside the software.

Additionally, Sage One accounting is easy to use and has a variety of integrations for further assistance. All in all, it’s an excellent choice for startup employees who want to keep track of their finances!

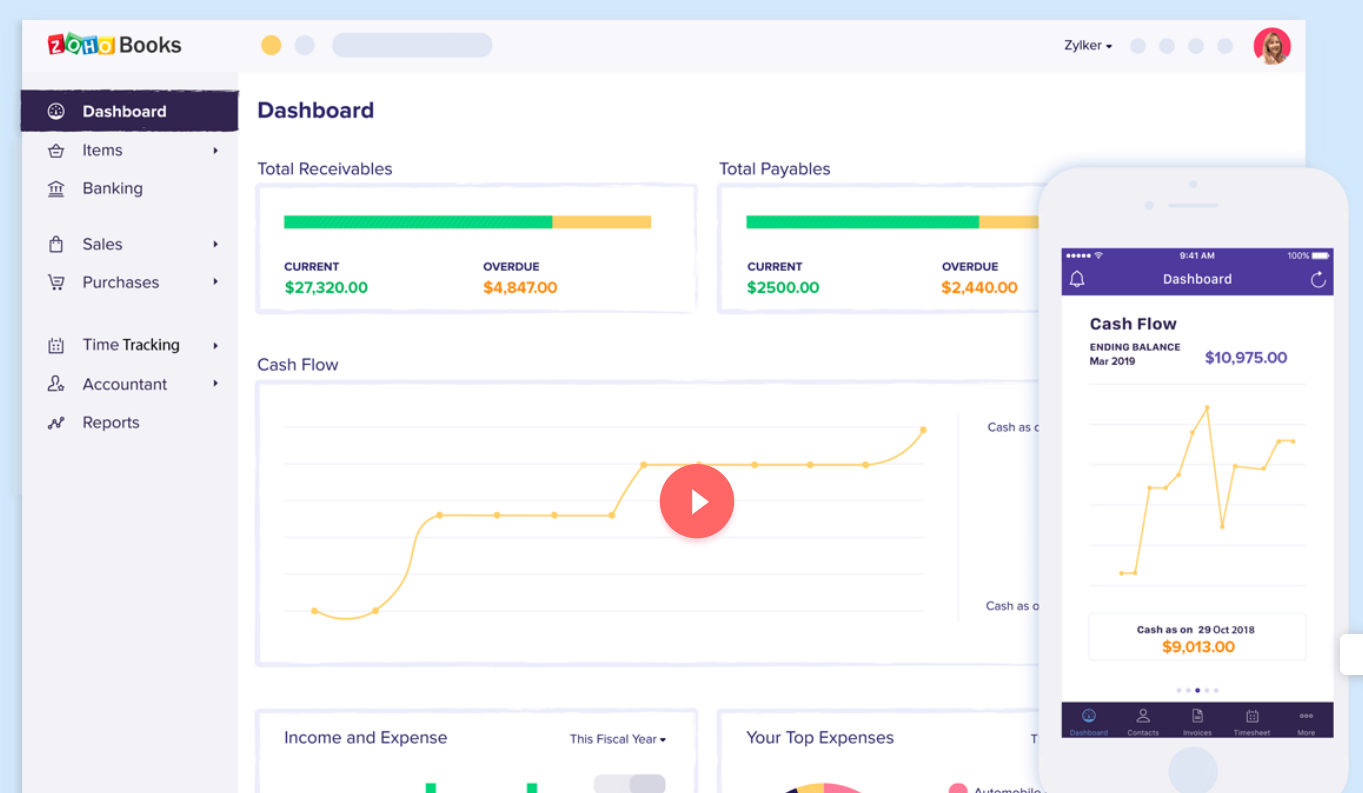

8. Zoho Books

Zoho Books is a popular cloud accounting software helpful for the online management of savings and finances. This app is mainly accounting software that can automate business workflows and help you work collectively across departments, which makes it a better fit for startup employees who work from home.

If your goal is to save money long-term, Zoho is another fantastic tool to assist you. This app can help you organize your finances and set economic goals with a few moves. It includes features for invoicing, estimates, client portals, expenses, bills, banking, projects, inventory, sales orders, sales tax, online payments, and more!

9. GoDaddy Bookkeeping

GoDaddy Bookkeeping is a cloud accounting software that helps startup employees and small businesses manage their finances and organize economic goals. The site is available at three pricing levels. The Get Paid plan at $4,99 per month is the simplest.

However, what makes GoDaddy Bookkeeping unique is its simplicity. It’s a helpful tool for people who are not accountants. It’s easy to use and understand, making it an excellent choice for startup employees who want to keep track of their finances without learning complex accounting jargon.

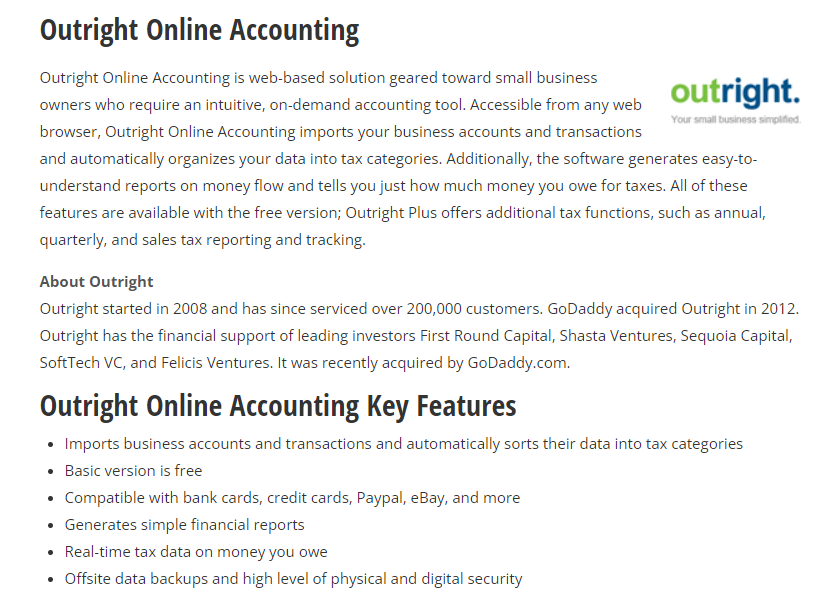

10. Outright

Outright is a helpful cloud accounting app to assist and guide startup employees and small businesses on their finances and savings. This app is unique because it offers tax assistance. Outright can help you prepare your taxes and even file them for you. Therefore, it is an exceptional feature for startup employees who need more time or to become more familiar with the tax filing process.

Plus, it has integrations with other apps you might use for your business. Overall, Outright is an excellent choice for startup employees who want to save time and money on their accounting and tax preparation.

Conclusion

Many accounting software and calculators help you save money as a startup employee. All of them will offer features for invoicing, accounting, payroll, project management, time tracking, tax saving, and more. If you’re a project manager, you can use these tools to track your expenditures, aside from adding them to your company knowledge base.

If you want to save money in the long term as a startup employee, these tools will help you out!